N.B. If you book a room on TripHop (to pocket half the booking commission paid to TripHop by hotels), consider using the link in the article. I get a small referral commission at no cost to you, enabling me to offer free content without any ads.

This Fortune survey says 46% of business travelers extend business trips for personal time and 54% occasionally bring a partner, friend, spouse or kids. Vacation-starved business travelers are reclaiming work-life balance by mixing business with pleasure, and are stretching their travel dollar at the same time.

When leveraged properly, business travel can afford you a travel lifestyle that might otherwise be unattainable. In my early corporate audit days, I stockpiled hundreds of thousands of points I later used for personal travel by:

- Paying business expenses on a personal credit card, and later getting reimbursed by the company.

- Enrolling to the loyalty program of every travel operator I stayed with.

- Extending business trips by a few days to explore the area on my own dime.

CLICK HERE to hear me discuss how to do this on Corporate Talk with Charlie & Eva.

If you work for a large company, chances are your employer has a corporate travel agent that books business trips for employees at preferred corporate rates. These companies often encourage employees book personal travel through their corporate travel agent. Booking your personal travel this way usually entitles you to:

- Corporate rates offering 10-15% off hotels.

- Flexible change and cancelation terms.

- Reasonable change fees.

- Unlimited mileage on car rentals.

If you have a professional designation, you likely have to earn continuing education credits on an ongoing basis to maintain your standing. A great way to piggy back your vacation with your conference is to lookup your associations' event calendar and look for conferences scheduled in cities you would also like to visit. The best time to bring this up with your boss is the year prior to the conference for funds to be budgeted.

If your company won't cover the cost of traveling to your conference, you might be able to at least claim the cost as a deductible expense. Seek the expertise of a tax professional for your specific situation.

If you travel for work, the easiest and most effective way to stockpile travel rewards for personal use is to pay your business expenses with a personal credit card that offers points/miles per dollar spent, and later claim those expenses to your company for reimbursement.

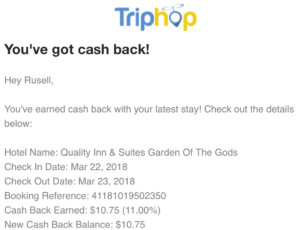

Pocket 10%+ of your Hotel Cost: Hotels pay booking websites a commission for rooms booked through their website. To get a piece of the commission earned from your hotel booking, book your room on hotel booking website TripHop which splits their booking commission with you. Commissions amounts vary by booking, yet it is not uncommon for your portion of the commission payout to exceed 10% of the rooms' cost:

TripHops' cash back payouts of 10% or more yields you a better return than what the best loyalty programs offer, which tend to be 1 free night per 10 nights stayed. Better yet, TripHop's cash back offer beats those free night programs because you your cash back upon checkout, and can spend it on anything you wish.

PRO TIP: When booking business travel on TripHop, use your personal credit card to pay for the room and claim the expense using your checkout receipt. Not only will your company refund you the amount paid for the room, but TripHop will also credit you half the commission they earned, which can be 10% or more of the room cost - that's free money in your pocket!

If you are a small business owner, imagine how many points you could stockpile by charging your payroll to a credit card that offers points per dollar spent. Jeff Young from Payroll Rewards Inc. explains you can do exactly that by having a third party middleman charge your credit card and transfer the funds to your payroll account.

But be warned, you will have to absorb any credit card vendor charges which range from 1.5 - 3% of the transaction value. Costs measured as a percentage balloon quickly when dealing with six and seven figure payrolls.

Before you buy global medical travel insurance, check to see if your medical benefits offered through your employer extend includes global coverage.

Once feeling unable to afford to travel, Russell Hannon uses lean principles to travel at a fraction of the going rate. He has been featured on CNBC, FOX, America Tonight, CBS, CTV, CBC, the National Post, Around the World Travel TV and nationally broadcast lifestyle and personal finance shows. He also wrote ‘Stop Dreaming Start Traveling: The Ultimate Guide to Traveling More & Spending Less.’

FREE GUIDE: Download ‘Beat the Best Online Fare – Every Time, Every Flight’ at BreakTheTravelBarrier.com